Pacific Prime Things To Know Before You Buy

Pacific Prime Things To Know Before You Buy

Blog Article

An Unbiased View of Pacific Prime

Table of ContentsThe smart Trick of Pacific Prime That Nobody is Talking AboutPacific Prime - QuestionsThe Single Strategy To Use For Pacific PrimePacific Prime Can Be Fun For AnyoneIndicators on Pacific Prime You Need To Know

Your agent is an insurance policy specialist with the understanding to assist you via the insurance policy process and aid you discover the most effective insurance policy protection for you and the people and points you respect a lot of. This post is for informative and pointer objectives just. If the policy insurance coverage descriptions in this write-up dispute with the language in the policy, the language in the policy applies.

Insurance policy holder's deaths can likewise be contingencies, especially when they are thought about to be a wrongful death, along with building damages and/or destruction. Due to the uncertainty of stated losses, they are identified as contingencies. The guaranteed individual or life pays a costs in order to receive the benefits assured by the insurance firm.

Your home insurance policy can aid you cover the problems to your home and pay for the expense of rebuilding or repair work. Sometimes, you can additionally have coverage for products or valuables in your house, which you can after that acquire substitutes for with the cash the insurer gives you. In the occasion of a regrettable or wrongful fatality of a sole income earner, a family members's economic loss can potentially be covered by certain insurance coverage plans.

5 Simple Techniques For Pacific Prime

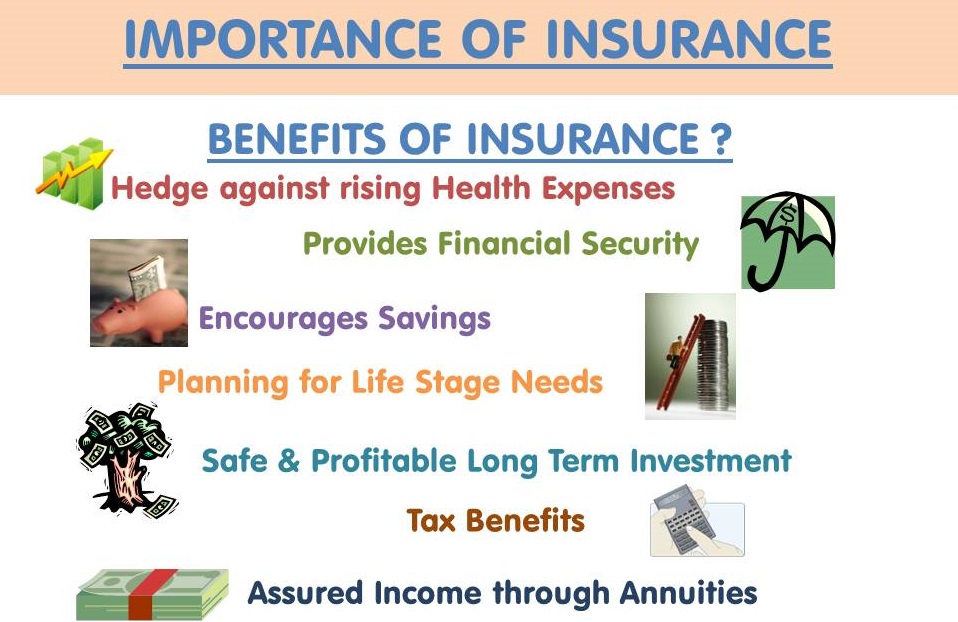

There are different insurance intends that consist of financial savings and/or investment plans along with regular protection. These can aid with building financial savings and wide range for future generations by means of normal or repeating financial investments. Insurance coverage can assist your family maintain their criterion of living in the occasion that you are not there in the future.

One of the most standard form for this type of insurance policy, life insurance policy, is term insurance. Life insurance in general assists your household become secure economically with a payment quantity that is given in the event of your, or the policy holder's, death throughout a particular plan duration. Child Strategies This kind of insurance policy is essentially a financial savings tool that assists with generating funds when kids reach specific ages for going after college.

Home Insurance coverage This kind of insurance coverage covers home problems in the occurrences of mishaps, all-natural catastrophes, and incidents, in addition to various other comparable events. international health insurance. If you are looking to look for compensation for accidents that have actually taken place and you are struggling to find out the proper path for you, connect to us at Duffy & Duffy Legislation Firm

Facts About Pacific Prime Uncovered

At our regulation firm, we understand that you are experiencing a whole lot, and we understand that if you are coming to us that you have actually been through a great deal. https://on.soundcloud.com/Boznd6XKBGjyrspT8. Due to that, we provide you a totally free consultation to look at your issues and see how we can best help you

Since of the COVID pandemic, court systems have actually been shut, which negatively influences auto mishap instances in a remarkable method. Again, we are right here to assist you! We happily serve the people of Suffolk Area and Nassau Area.

An insurance coverage is a lawful agreement in between the insurance policy company (the insurance firm) and the person(s), company, or entity being insured (the insured). Reviewing your plan aids you validate that the policy meets your requirements and that you comprehend your and the insurer's duties if a loss takes place. Many insureds acquire a plan without understanding what is covered, the exclusions that remove protection, and the conditions that need to be satisfied in order for protection to apply when a loss happens.

It determines who is the insured, what risks or building are covered, the plan restrictions, and the policy period (i.e. Check This Out time the policy is in pressure). For instance, the Statements Page of an auto plan will certainly consist of the summary of the lorry covered (e.g. make/model, VIN number), the name of the person covered, the premium quantity, and the deductible (the quantity you will certainly need to spend for a claim before an insurance provider pays its portion of a protected claim). The Declarations Web page of a life insurance policy will certainly consist of the name of the individual guaranteed and the face quantity of the life insurance coverage policy (e.g.

This is a recap of the major assurances of the insurer and mentions what is covered. In the Insuring Arrangement, the insurance provider agrees to do specific points such as paying losses for covered hazards, providing certain solutions, or agreeing to protect the guaranteed in a liability suit. There are 2 standard forms of an insuring contract: Namedperils insurance coverage, under which just those dangers particularly provided in the policy are covered.

Getting My Pacific Prime To Work

Life insurance policy plans are typically all-risk plans. http://dugoutmugs01.unblog.fr/2024/04/02/pacific-prime-your-partner-for-comprehensive-insurance-solutions/. The 3 major types of Exemptions are: Left out risks or causes of lossExcluded lossesExcluded propertyTypical examples of excluded risks under a home owners plan are.

Report this page